Let’s be honest: cryptocurrency isn’t what it sounds like today. If you ask me, just a few years ago, it felt like another advertisement on television, in newspapers, or on billboards. Very few cared. But now, blockchain and cryptocurrency continue to evolve at a rapid pace. This evolution includes regulatory bodies worldwide working to establish frameworks that balance customer protection and compliance, among other factors.

In 2025, government initiatives stepped in, and regulations became vigilant worldwide. The regulations have involved smart contracts, making it convenient for investors to focus on the legal side of crypto. Regulatory measures aren’t optional but vital for every investor to understand the current landscape in crypto. If you’re either investing, thinking about investing, or just gaining knowledge regarding digital currencies, this year, keep your fingers swiping down till the end of the post.

This blog post shall walk you through the Need-to-Knows of Cryptocurrency regulations in 2025. No fluff, no complex jargon—just clear insights, structured information, and practical takeaways to help you invest smart and stay compliant.

Is Cryptocurrency Legal?

Let’s start with the most basic question: Is cryptocurrency legal? The answer depends on your geographical location.

In most countries, yes—owning and trading cryptocurrency is legal. However, that legality often comes with strings attached: registration requirements, taxation policies, identity verification laws, and reporting obligations.

Here’s a quick snapshot of legality across key regions in 2025:

European Union: Crypto is legal, and new regulations under the Markets in Crypto-Assets (Mica) framework are now in force, bringing stricter compliance, transparency, and protection for investors.

United Kingdom: The UK recognises crypto as property, and businesses must register with the Financial Conduct Authority (FCA). All exchanges must comply with anti-money laundering (AML) rules.

Asia: Countries like Japan, South Korea, and Singapore have comprehensive legal frameworks. Meanwhile, China maintains a strict ban on crypto trading.

Middle East and Africa: Regulation varies—UAE and Bahrain have supportive crypto frameworks, while other countries remain cautious or restrictive.

Latin America: Nations like El Salvador embrace Bitcoin, while others remain sceptical and lack regulatory clarity.

Australia & Canada: Crypto is legal, with active monitoring and registration requirements through financial regulators.

So yes, crypto may be legal where you are, but that doesn't mean it's unregulated.

Why Does Crypto Regulation Matter?

Because crypto is still a relatively new asset class, laws are evolving rapidly. And unlike traditional financial products, crypto lacks universal standards.

Here’s why staying informed is critical:

Tax implications: In many countries, profits from crypto are taxable.

AML/KYC compliance: To prevent money laundering, most exchanges must verify user identity.

Licensing and registration: Many regions require crypto companies to obtain government licenses.

Consumer protection: Some jurisdictions now mandate exchanges for better security and disclosure.

Understanding local crypto laws could result in frozen accounts, tax penalties, or criminal charges.

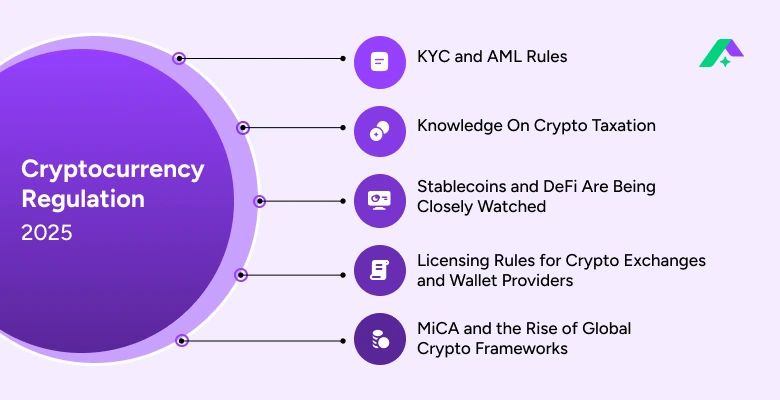

The Major Crypto Regulations Investors Should Know in 2025

Regulations differ globally, but many trends are shared across borders. Below are some of the most significant rules shaping crypto investment today.

1. KYC and AML Rules

Most countries now require crypto platforms to:

Verify users’ identities (Know Your Customer)

Report suspicious transactions (Anti-Money Laundering)

This helps prevent fraud, but it also reduces user privacy.

2. Knowledge On Crypto Taxation

Crypto is no longer a loophole in the tax system. Over 50 countries now have clear tax rules for digital assets, and the number keeps growing. Tax compliance is becoming unavoidable whether you’re an individual investor, a miner, or a business accepting crypto.

Here’s how different types of crypto activities are typically taxed:

Capital Gains Tax: If you sell your crypto for a profit—even if you just exchanged it for another coin—you may owe capital gains tax. The amount depends on how long you held the asset and your country’s tax rates.

Income Tax: Earning crypto through staking, mining, or airdrop rewards? Most countries treat these as income. You must report their market value at receipt and pay taxes accordingly.

Business or Transaction Taxes: A merchant accepting crypto as payment may be treated like regular income or subject to VAT (Value-Added Tax) or sales tax, depending on your region.

Crypto-to-Crypto Swaps: Even if you don’t convert crypto to fiat, swapping one token for another can trigger taxable events in many jurisdictions.

In short, tax authorities are closely monitoring blockchain activity. Tools like blockchain analytics and exchange reporting requirements make tax evasion in crypto increasingly difficult.

Tip for Investors: Keep detailed records of all your transactions—including dates, amounts, and wallet addresses. Many countries now require this for annual tax filings. When in doubt, consult a crypto-savvy tax advisor.

3. Stablecoins and DeFi Are Being Closely Watched

After significant failures like TerraUSD, many governments closely monitor stablecoins (cryptos that try to stay equal to the value of a real currency like the US dollar) and DeFi platforms (decentralised financial apps).

Now, some countries have rules that say:

Stablecoins must be backed by real money in a bank (e.g., having $1 in cash for every $1 in stablecoin).

Auditors must regularly check these reserves to prove they exist.

This is to protect investors and avoid future crashes.

4. Licensing Rules for Crypto Exchanges and Wallet Providers

Crypto exchanges today operate in a more regulated environment than ever before. In most countries, these platforms can no longer operate freely without approval. Governments now require exchanges and wallet services to register with financial authorities, follow strict KYC (Know Your Customer) procedures, and meet cybersecurity standards.

If a platform fails to meet these legal requirements, it could face fines, be blocked in certain regions, or even be shut down completely. Investors should always check whether an exchange or wallet service is licensed or regulated in their country before using it.

5. MiCA and the Rise of Global Crypto Frameworks

In 2025, countries will take a more unified approach to crypto regulation.

The European Union has taken a significant step forward with MiCA—short for Markets in Crypto-Assets. This law sets clear rules for how crypto companies must operate within the EU. It covers everything from launching new cryptocurrencies (ICOs) to managing stablecoins and safely storing users’ digital assets.

Basics of Protecting Your Cryptocurrency

Let’s assume you’ve ticked all the right boxes—done your KYC, paid your taxes, and only trade on licensed platforms. Great. But here’s the thing: none of that will matter if your crypto gets stolen.

Crypto regulation is about staying compliant with the law, but crypto safety is about protecting your assets from the everyday threats of being part of a decentralised ecosystem. Unlike banks, there’s no customer support hotline if something goes wrong. If someone drains your wallet, it’s gone—no refunds, no chargebacks.

Here are a few basics that every investor, whether beginner or experienced, must know when it comes to safeguarding their digital assets:

Enable two-factor authentication (2FA) for your exchange accounts and wallets. This simple step adds a strong second layer of defence against unauthorised access.

Don’t keep all your funds on an exchange. Withdraw your crypto to a wallet you control. You're not fully controlling your money if you’re not holding the private keys.

Speaking of wallets, write down your recovery phrase or seed words on paper and store it somewhere safe, preferably offline. Avoid digital copies at all costs.

Use strong, unique passwords for everything related to crypto. And by strong, we mean random and hard to guess, not your pet’s name followed by your birth year.

For serious holdings, consider investing in a hardware wallet. These devices store your private keys offline, making them immune to most online threats, When choosing where to store your crypto securely, exploring options for the best bitcoin wallet can help you compare features like offline storage, ease of use, and backup protection.

Be cautious of phishing attempts. Emails, pop-ups, or websites that look exactly like your favourite crypto platform can trick you into revealing your passwords or seed phrases. Always double-check URLs and never download software from sketchy sources.

Never enter your recovery phrase on a website, no matter how convincing it looks. If anyone asks for it, they’re trying to scam you.

Avoid using public Wi-Fi when checking your crypto accounts. Use a VPN App to protect your connection from prying eyes if you must.

In short, crypto safety isn’t about doing one big thing right—it’s about consistently following good habits. Just like you wouldn’t leave your wallet lying around in public, don’t leave your digital wallet unprotected online.

Are Offshore Exchanges Safe or Risky?

Offshore exchanges—those not regulated by your local government—offer benefits like:

More coin choices

Lower fees

Fewer identity checks

But they also come with serious risks:

Limited legal protection

Withdrawal restrictions

Risk of sudden bans or closures

While some offshore platforms are reputable, others may operate in grey areas. If an offshore exchange is hacked or vanishes, recovering your funds may be impossible.

Tip: Use exchanges registered and licensed in your region whenever possible.

How to Check if a Crypto Platform Is Regulated?

Here’s a simple checklist:

Is the exchange or wallet provider registered with a local financial authority?

Do they follow KYC/AML rules?

Do they offer transparency on fees, cold wallet reserves, and audits?

Have they published a security or privacy policy?

Can you find complaints or investigations linked to them online?

Reputable platforms often publish their compliance status and licenses on their websites.

Disclaimer

The information provided in this blog is for general educational and informational purposes only. It does not constitute financial, investment, or legal advice. We do not recommend or endorse cryptocurrency buying, selling, or trading. Always do your research before making any financial decisions. The content here is provided “as is” with no guarantees of accuracy or completeness. Neither the author nor StarAgile will be held responsible for any losses, decisions, or actions taken based on the information shared in this article.